jefferson parish property tax records

3 rows Jefferson Parish Code Enforcement Offices. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Start Your Homeowner Search Today.

. The median property tax in Jefferson Parish Louisiana is 75500. Jefferson Parish Code of Ordinances Section 2-151 requires the Parish. Jefferson Parish is ready for Carnival season.

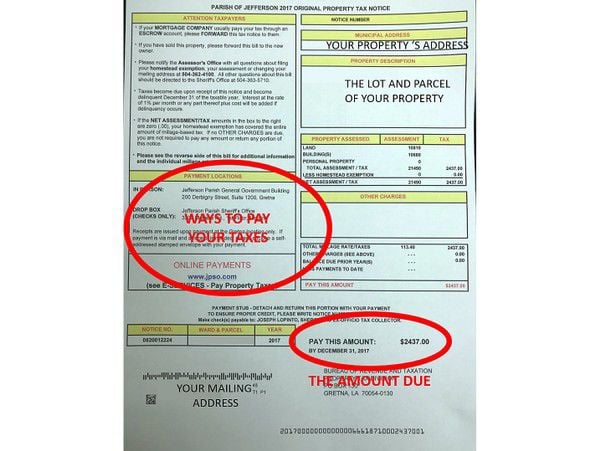

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Ad Find property ownership and title history look into sale prices mortgages foreclosures. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2021 assessments will be updated on the website.

Find the tax assessor for a different Louisiana county. Search By Tax Year Payments are processed immediately but may not be reflected for up to 5 business days. Search Jefferson Parish property tax and assessment records by parcel number owner name address or property description.

TO MAINTAIN SOCIAL DISTANCING SEATING WILL BE. All of the Jefferson Parish. 1801 Williams Blvd Kenner LA 70062 Police 504 712-2222 or 911 Fire Department 504 467-2211 or 911 City Hall.

Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Just Enter Your Zip to Start. Get Property Records from 2 Code Enforcement.

Laissez le bon temps rouler. Title History ownership title. Ad Just Enter your Zip Code for Property Records in your Area.

Public Records Request. Property Tax The Jefferson County Sheriffs Office is the primary property tax collector for state metro Louisville district school fire and other special district taxes. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Tax Assessor-Collector of Jefferson County Texas. The Jefferson Parish Assessors Office determines the taxable assessment of property.

Get In-Depth Property Tax Data In Minutes. Search Any Address 2. Welcome to the Jefferson Parish Assessors office.

Search Jefferson Parish property tax and assessment records by parcel number owner name address or property description. Assessor Jefferson Parish Assessor 200 Derbigny St Suite. Yearly median tax in Jefferson Parish.

See Property Records Tax Titles Owner Info More. Titles Deeds Liens Building Permits Parcel Maps. Find Property Tax Records Get Accurate Home Values Online.

Punctuation city state and zip codes are not needed. To find all properties on a specific road type in the name of the street. Property Reports ownership information property details tax records legal descriptions.

Jefferson Parish collects on. Find property records for Jefferson Parish. Jefferson Property Records provided by HomeInfoMax.

SHERIFF SALE SCHEDULED FOR TUESDAY MARCH 1 2022. For a tax research certificate for purposes of LA RS. Free Jefferson Parish Assessor Office Property Records Search Find Jefferson Parish residential property tax assessment records tax assessment history land improvement values district.

Expert Results for Free. Assessor Jefferson Parish Assessor 200 Derbigny St Suite. Search the Louisiana Birth Records Index Database through the Secretary of State and order certified copies of birth certificates for births that occurred in Louisiana more than 100 years.

Residential - Commercial - Land. JEFFERSON PARISH MARDI GRAS. Parish Taxes View Pay Water Bill BAA Fine.

815 W Market St Search for all. Ad Find Out the Market Value of Any Property and Past Sale Prices. If your homesteadmortgage company usually pays your property taxes please.

68 97ac 65 2 Leaf River In Jones County Mississippi Leaf River Jones County Land For Sale

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Pin On Capitalism Class Warfare

E Services Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com